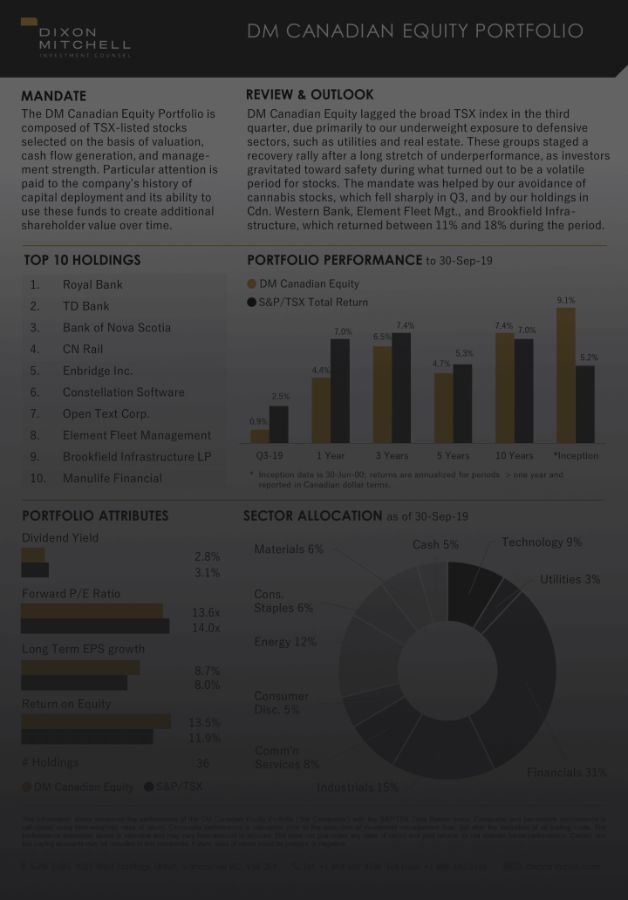

The Dixon Mitchell Canadian Equity Portfolio invests in the shares of mid and large capitalization Canadian companies which display a distinct competitive advantage over their peers and an ability to generate and grow free cash flow. Significant attention is paid to valuation and to the management team’s operational track record and its strategy for future value creation through capital deployment. This mandate is available in both separately managed and pooled formats.

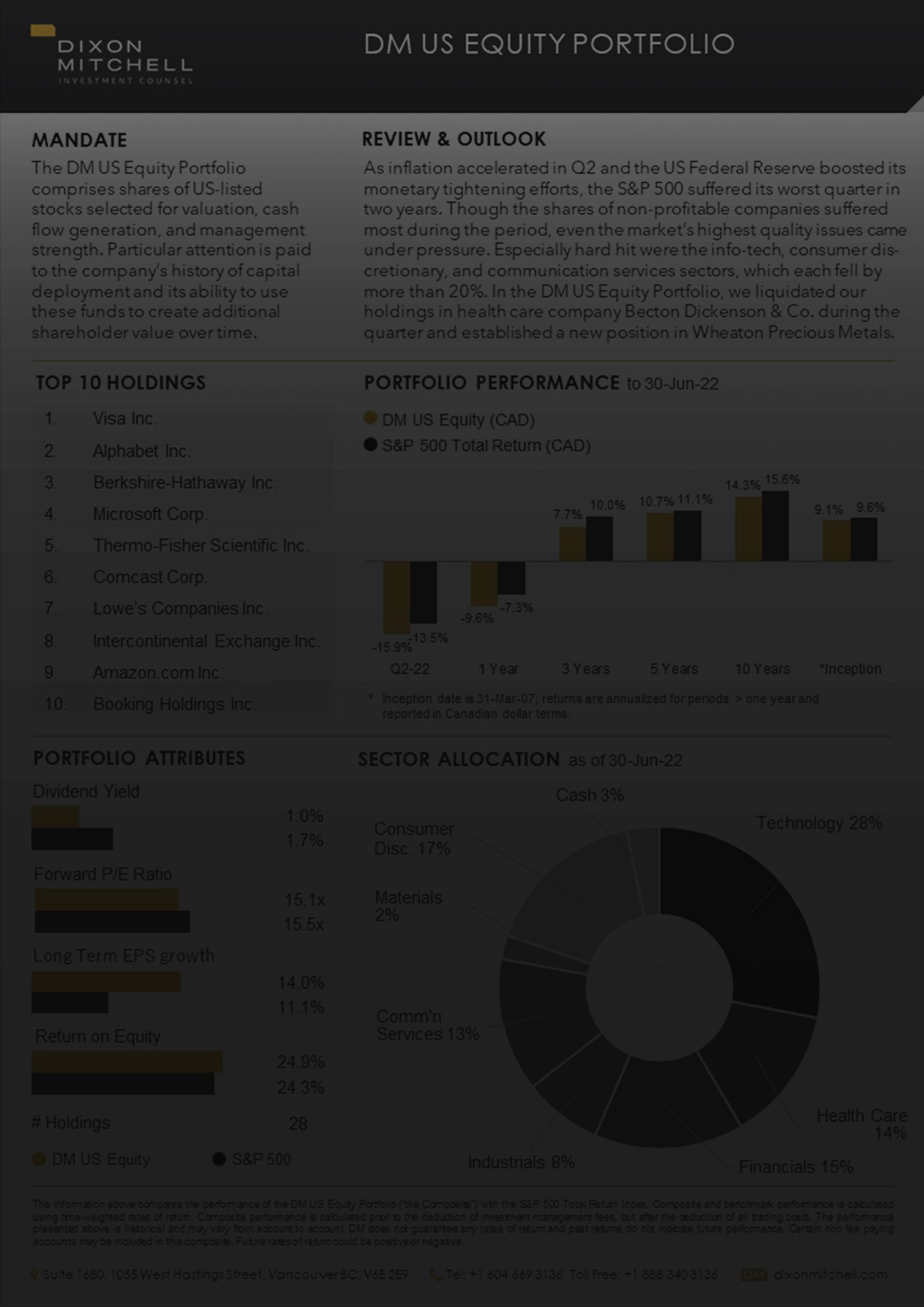

DownloadThe Dixon Mitchell US Equity Portfolio invests in non-Canadian stocks listed on major US exchanges. It targets high quality businesses with one or more of the following characteristics: a strong competitive position, recognized industry leadership, dominance in a specific niche, or a uniquely effective management team and philosophy. Once a business that meets these criteria has been identified, extensive fundamental analysis is undertaken to determine whether it is a candidate for the portfolio. This mandate is available in both separately managed and pooled formats.

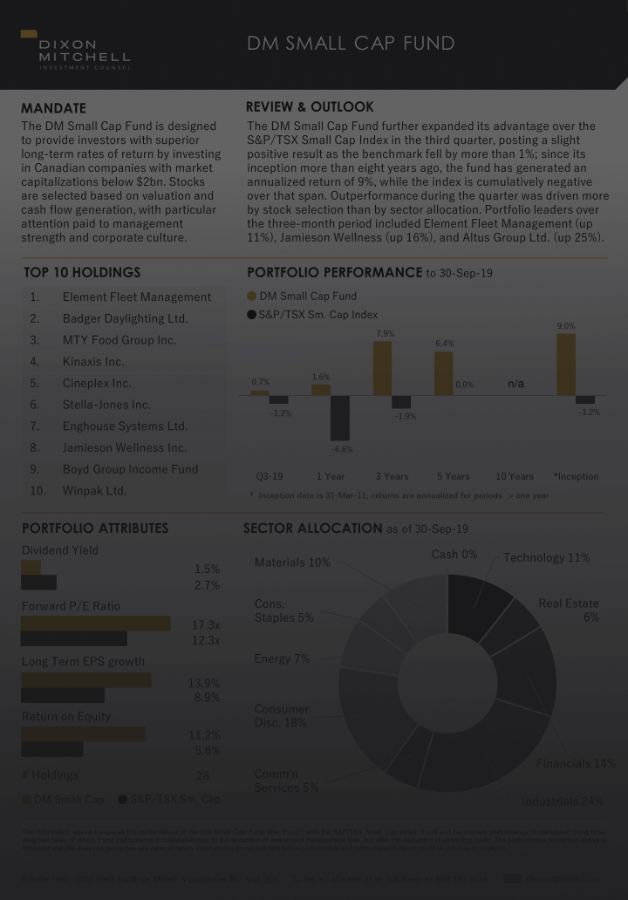

DownloadThe Dixon Mitchell Small Cap Fund invests in Canadian stocks with market capitalizations of $2 billion or below. Investment decisions within this portfolio are generated through the same investment process that DM follows for its other equity mandates, with additional time devoted to executive interviews and site visits. The fund targets companies in the growth phase of their life cycle, with internal capital typically devoted to organic growth or M&A activity, rather than shareholder distribution. This mandate is available in pooled form only.

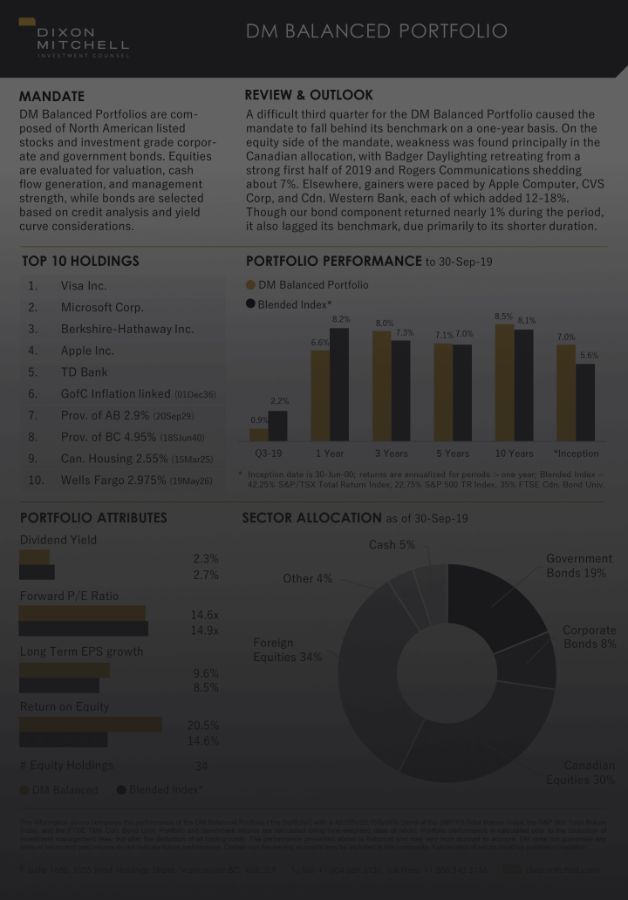

DownloadDixon Mitchell Balanced Portfolios are created on a customized basis by blending combinations of the preceding equity mandates with allocations to the DM Bond Model. Unique asset mixes are recommended to reflect the goals, circumstances, and risk tolerance of each client. The DM Balanced Portfolio Composite captures the weighted average return of all such portfolios managed by Dixon Mitchell and is intended to represent the experience of our typical balanced client. This mandate is available in separately managed form only.

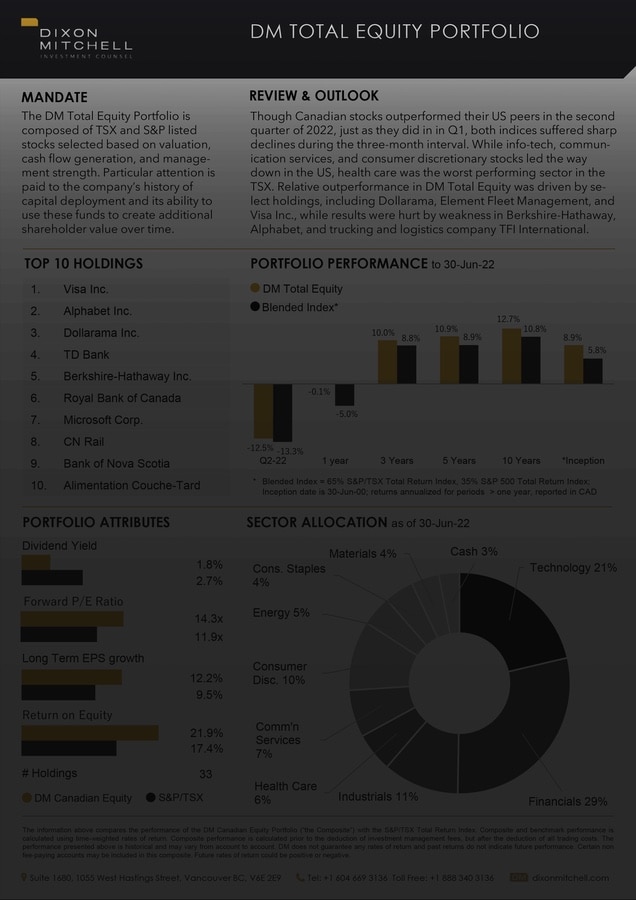

DownloadThe Dixon Mitchell Total Equity Portfolio is a blended North American mandate composed of a concentrated group of stocks selected from the DM Canadian and DM US Equity Portfolios. DM Total Equity is available in a segregated format and follows the same investment philosophy that guides our other equity offerings.

Download